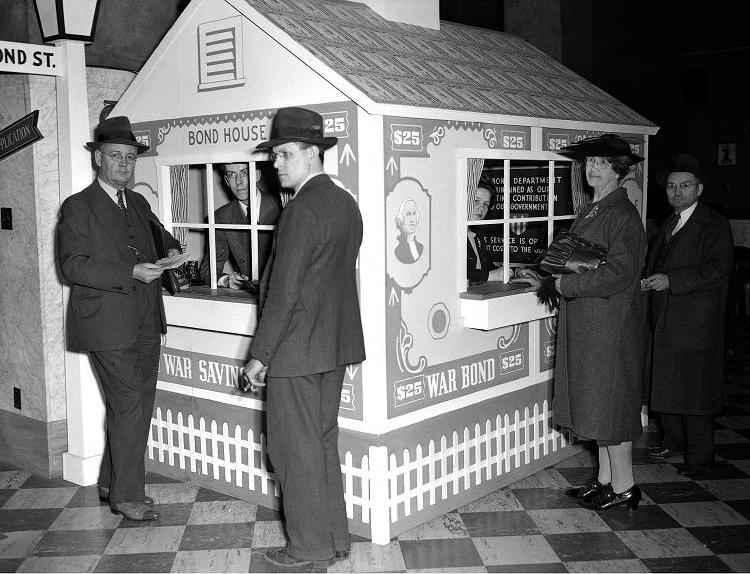

Founded in 1887 by William T. Cannon, paymaster of the Indianapolis Union Railroad, Railroadmen’s Federal Savings and Loan Association originally assisted railroad workers to save money and invest in new homes. By consistently focusing on home mortgages, Railroadmen’s grew steadily and claimed to be the largest savings and loan association in the world by the 1920s. A dependable business, it grew even larger after World War II by offering mortgages to returning veterans.

For the next 30 years, the company remained a solid financial investment, but deregulation of the banking industry, high interest rates, and inflation created financial strain for the firm in the 1980s. In 1984, Railroadmen’s posted a net loss of 1.4 percent but returned to profitability within the next three years with a 2.1 percent growth.

The company switched from mutual ownership to stock ownership in 1987. Attesting to its conservative investment practices, the company’s stock hit its highest point during the national savings and loan crisis of the late 1980s, when bad investments forced many savings and loans to file for bankruptcy.

Continuing to focus on residential mortgages, Railroadmen’s purchased or merged with the following institutions: Brown County Federal Savings and Loan (1981), Heritage Federal Savings Bank (1987), and Archer Federal Savings and Loan (1991). This activity, resulting in a total of 15 bank offices and 185 employees, made Railroadmen’s one of the largest savings and loans groups in the state.

In 1992, the company posted record earnings of $6.61 million, an increase attributable to mortgage loan production. In November 1993, Railroadmen’s shareholders voted to merge with the Ohio-based Huntington Bancshares, Inc., for $88 million.

Help improve this entry

Contribute information, offer corrections, suggest images.

You can also recommend new entries related to this topic.