Since the 1990s, law firm mergers have brought new firms to Indianapolis, strengthened existing firms, and erased long-established names from the local legal marketplace. Firms have generally combined to deepen their pool of expertise, offer more services to clients, attract new clients, and expand their geographical footprint. Merger discussions between law firms often focus on compensation schedules and who will serve in leadership positions.

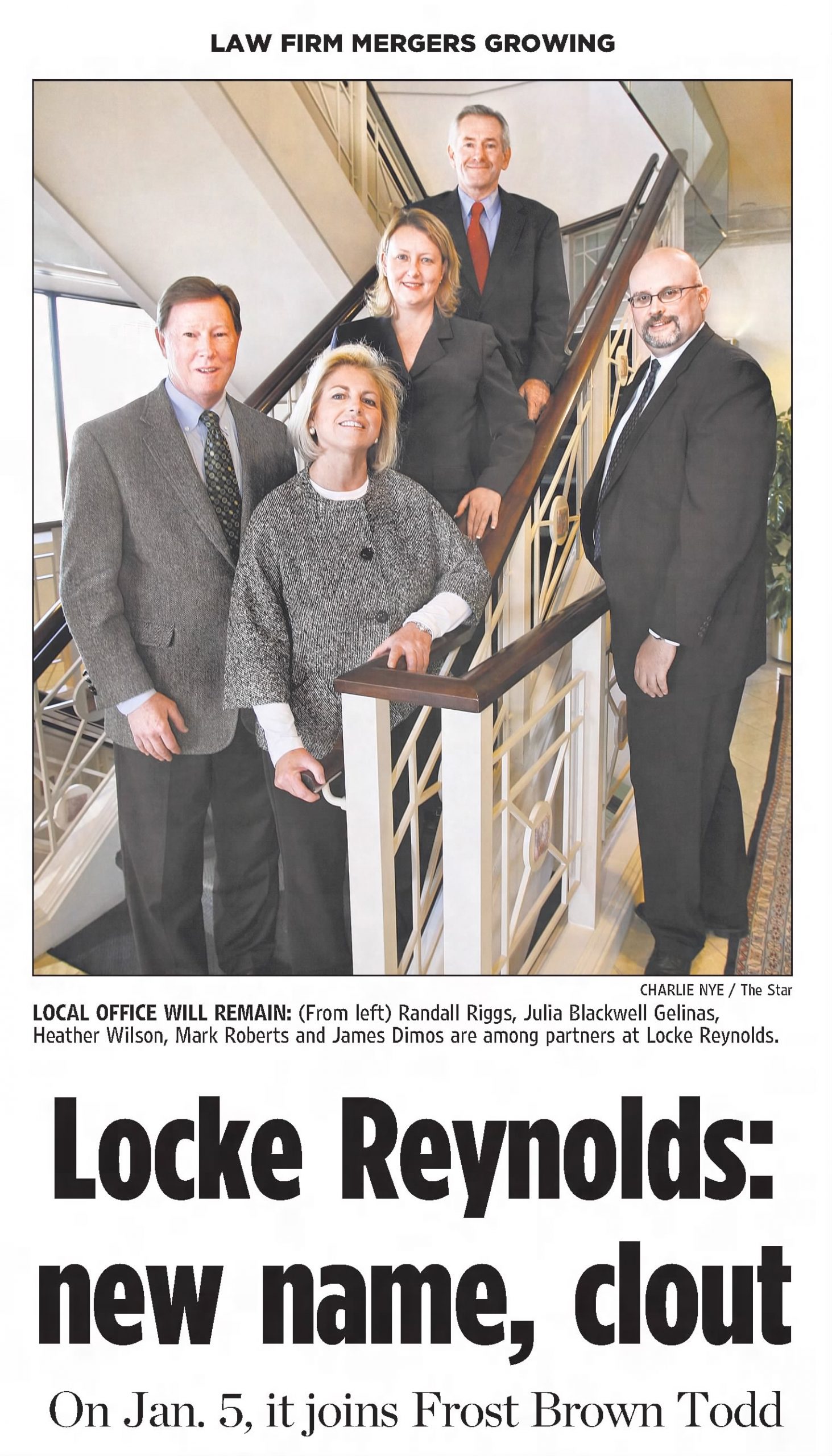

The trend of law firm mergers nationally began in the mid-1990s and has increased since the Great Recession in 2008, with the peak in 2019 with 116 mergers. Indianapolis has been part of this larger trend. Sommer Barnard and Locke Reynolds announced in 2008 they were being acquired by regional competitors. Taft Stettinius & Hollister, then based in Cincinnati, Ohio, bought the local firm, which at the time had 103 attorneys and was the seventh-largest firm in Indianapolis. Meanwhile, Frost Brown Todd of Louisville was listed as among the 150 largest law firms by the National Law Journal when it absorbed Locke Reynolds which had 79 attorneys in Indianapolis and four in Fort Wayne.

Ice Miller, then Indianapolis’ largest firm, also announced merger plans in 2008. It was in talks with Louisville-based Greenebaum Doll & McDonald PLLC and expecting the deal would be completed by the start of 2009. However, negotiations broke down over differences in the way partners were compensated and concerns the merger would lead to higher legal fees for Greenebaum clients as they were already struggling in the Great Recession.

Greenebaum came to Indiana through a combination announced in late 2011 with Bingham McHale LLP with offices in Indianapolis, Evansville, Jasper, and Vincennes. The resulting firm, Bingham Greenebaum Doll LLP, had 247 attorneys, which ranked it 166 on the 2011 National Law Journal annual survey of the 250 largest law firms in the United States.

The merger activity that blossomed after the Great Recession reflected a shift in the relationship between lawyers and their corporate clients.

From the late 1950s to the early 1960s, law firms enjoyed a “golden era” as the attorneys were able to develop long-term relationships with their clients and were called upon to handle most of their clients’ legal matters. In the 1980s, the relationship changed as corporations built their in-house legal departments to perform many of the tasks previously done by the outside attorneys. Business clients no longer considered law firms as their trusted advisors but began soliciting and hiring different firms for specific jobs and services that could not be done in-house.

Law firms had to compete regularly for work from the same clients. Firms had to reduce fees and prove ability, among other factors, to win the new business. Mergers seemed to be a consequence as law firms said their growth would help serve the needs of existing clients as well as new clients.

Baker & Daniels, which was founded in 1863 as Hendricks & Hord, has opted for expanding its reach through mergers with large firms rather than by acquiring small firms. In 2011 as law firm mergers and acquisitions were recovering from the economic downturn, it announced plans to combine with Faegre & Benson in Minneapolis. The new Faegre Baker Daniels had about 800 attorneys in 13 offices across the U.S. as well as London, Shanghai, and Beijing.

Another combination announced in 2019 expanded Faegre Baker Daniels to more than 1,300 attorneys and consultants in 22 offices worldwide. The Indianapolis firm merged with Drinker Biddle & Reath, based in Pittsburgh, to create Faegre Drinker Biddle & Reath, which produced a combined firm positioned to not only be a leader in several industries like construction, health and life sciences, and financial services but also to earn annual gross revenue of nearly $1 billion. In December 2019, Drinker Biddle & Reath and Faegre Baker Daniels voted to merge and become Faegre Drinker as of February 2021.

Bingham also unveiled merger plans in 2019, this time with the global giant Dentons to form Bingham Greenebaum Dentons. The combination is part of Dentons’ plans to create a national law firm through a new business model that would allow the local firms to retain some autonomy but be able to draw upon the resources as well as use the technological capabilities of the global firm.

Not all mergers have ended happily. Dann Pecar Newman & Kleiman PC had been looking for a merger partner for a few years, even having discussions with other Indianapolis firms, when it decided to join Cleveland, Ohio-based Benesch Friedlander Coplan & Aronoff in 2010. The Indianapolis firm said the combination would bring greater resources, like adding the practice areas of health care and intellectual property. However, Benesch closed the Indianapolis location in 2018 after nearly all the remaining lawyers in that office migrated to Taft.

The (IBJ) reported in September 2022 that, although the COVID-19 pandemic cooled what previously had been a “very hot” environment for law firm mergers, conditions that drove growth before 2020 were still at play. The IBJ also noted that a need for talent presented a key pressure for mergers. At this time, Taft Stettinius Hollister announced that it was expanding its footprint in the Midwest, merging with Jaffe Raitt Heurer & Weiss in Detroit to become the fourth-largest law firm in Indianapolis.

Help improve this entry

Contribute information, offer corrections, suggest images.

You can also recommend new entries related to this topic.