Six businessmen–Frank Manly, Albert Goslee, and brothers Charles, Edward, George, and Joseph Raub–organized Indianapolis Life on July 4, 1905. Six days later, Indianapolis Life was incorporated as a mutual life insurance company, which meant policyholders (rather than stockholders) owned the company. This structure was unusual because most insurance companies at this time were founded as stock companies that evolved into mutual companies when the stock was retired.

By November 1905, Indianapolis Life had sold the 250 life insurance policies required to officially engage in business. Two years later, the company relocated from its first office in the building to a larger space in the newly constructed building.

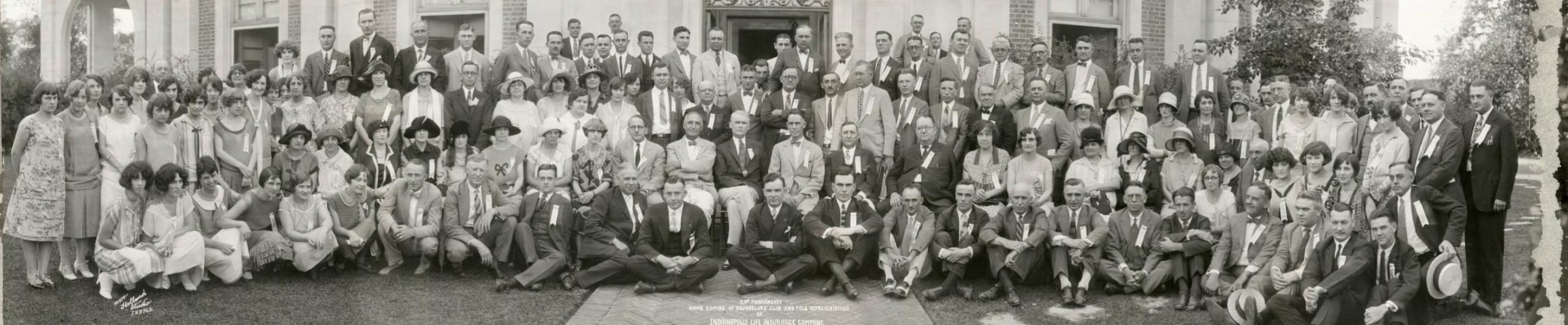

In 1923, the insurer purchased the mansion of former U.S. Vice President at 29th and Meridian streets for its home office. A series of additions were made in 1956, 1960, 1980, and 1985 to the back of this property to accommodate the company’s growth.

Throughout its history, Indianapolis Life specialized in individual life, annuity, and disability insurance. As the company grew, its financial figures increased. During the insurer’s golden anniversary in 1955, it reported $95 million in assets and $324 million in life insurance policies. In the early 1990s, over $1 billion in assets and more than $11 billion in life insurance policies were listed.

In addition to the Fairbanks Mansion, Indianapolis Life’s headquarters expanded to include the adjoining Louis H. Levey Mansion, which the company purchased in 1978, and a larger office building for employees (one section built in 1950 and the other constructed in 1980). The properties on this campus, known as Historic Square, underwent renovation from 2000 to 2001.

After a 1997 merger agreement with American United Life (later known as ) fell through, Indianapolis Life announced in January 2000 its consolidation with Iowa-based American Mutual Holding Company (AMHC) in a $368 million cash-for-stock deal. Upon publication of this news, Indianapolis Life was the eighth-largest Indiana-based life insurer with assets of $5.7 billion.

The AMHC merger took 18 months to complete. When both insurers converted from mutual-owned companies to stock-based entities, AMHC reportedly issued 11.25 million shares in the new stock company, AmerUs Life Group to Indianapolis Life policyholders. It also made a $100 million investment in the subsidiary Indianapolis Group Life. Hundreds of layoffs followed in the aftermath of this consolidation. For Indianapolis Life Group, the reduction in workforce resulted in the relocation of the company from its Historic Square campus to much smaller offices at Keystone at the Crossing. The International Medical Group purchased the Historic Square campus in 2004.

On November 15, 2006, British-based Aviva PLC announced its agreement to purchase AmerUsLife Group for $2.9 billion. All of AmerUs’ major subsidiaries, including Indianapolis Life, were included in this deal. Two years later, Aviva’s Board and Directors signed a resolution that led to the demise of Indianapolis Life.

Help improve this entry

Contribute information, offer corrections, suggest images.

You can also recommend new entries related to this topic.