In 1972, , John Rosebrough, and John Wynne formed the construction and development firm P. R. Duke & Associates. Shortly after its inception, the team purchased the struggling Park 100 industrial complex in . Duke transformed Park 100 into one of the country’s largest industrial parks, eventually encompassing 1500 acres.

The firm adopted a vertically integrated approach to the real estate business, establishing five operating companies to support their development activities. Once these companies were well established in Indianapolis, Duke expanded into its second market, Cincinnati, in 1977.

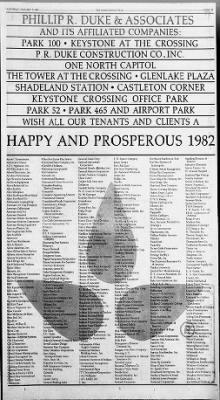

In 1978, Duke & Associates acquired the foundering Keystone at the Crossing mixed-use project. Located on Indianapolis’ northeast side, the firm developed this complex to include high-rise office buildings, hotels, restaurants, and retail space. Part of this work also included the $25-million expansion of The Fashion Mall in the late 1980s. (Duke later sold its shares of the mall in 1989.)

The 1980s was also a period of massive development in downtown Indianapolis. Duke was an important player in this effort, particularly with the construction of large office spaces. Two of these properties include One North Capitol and First Indiana Plaza (known as BMO Plaza in 2020).

In 1985, the company decided to package several of its properties into a real estate investment trust (REIT) called Duke Realty Investments. The following year, founders Phillip Duke and John Rosebrough sold their interests in the five operating companies of Duke & Associates to a partnership headed by the third founder John Wynne. Three months after this sale, Phillip Duke died of a heart attack in Florida.

As REITs became more attractive mainstream investment options, the company decided to go public. In October 1993, Duke Realty Investments acquired Duke Associates and then completed an initial public offering (IPO) of stock that raised more than $310 million. Funds generated by the IPO helped improve the company’s balance sheet and put it in an excellent position to raise capital in the future to grow its portfolio.

Throughout the 1990s, most of Duke’s properties were in the Midwest. In 1999, the company acquired Atlanta-based Weeks Corporation. This merger gave the firm, now known as Duke-Weeks Realty Corporation, an entrance into new and fast-growing markets throughout the southeastern United States.

In 2001, the company was renamed Duke Realty Corporation. For the rest of the decade, the firm focused its expansion on the eastern and western portions of the country. Duke Realty was present in 20 major U.S. markets and specializes in industrial development, leasing, property management, and construction.

In June 2022, Duke Realty entered into a merger agreement with Prologis, headquartered in San Francisco. Prologis agreed to take over Duke’s debt in the $26 billion stock-to-stock deal, which included 153 million square feet of properties in 19 major U.S. logistics markets, 11 million square feet of property in the progress of development, and 1,228 acres of land under option for development.

Help improve this entry

Contribute information, offer corrections, suggest images.

You can also recommend new entries related to this topic.