In 1834, the Indiana General Assembly granted a 25-year charter for the Second . Branches were located around the state, including Indianapolis, to provide currency and short-term commercial and agricultural loans. The charter for the Second State Bank expired in 1857, and many of the same investors sought a charter for the third state bank, the Bank of the State of Indiana. In 1865, after investors of the Indianapolis branch secured a national charter under the National Banking Act of 1863, the charter of the third state bank was allowed to expire. The new bank was called the Indiana National Bank of Indianapolis.

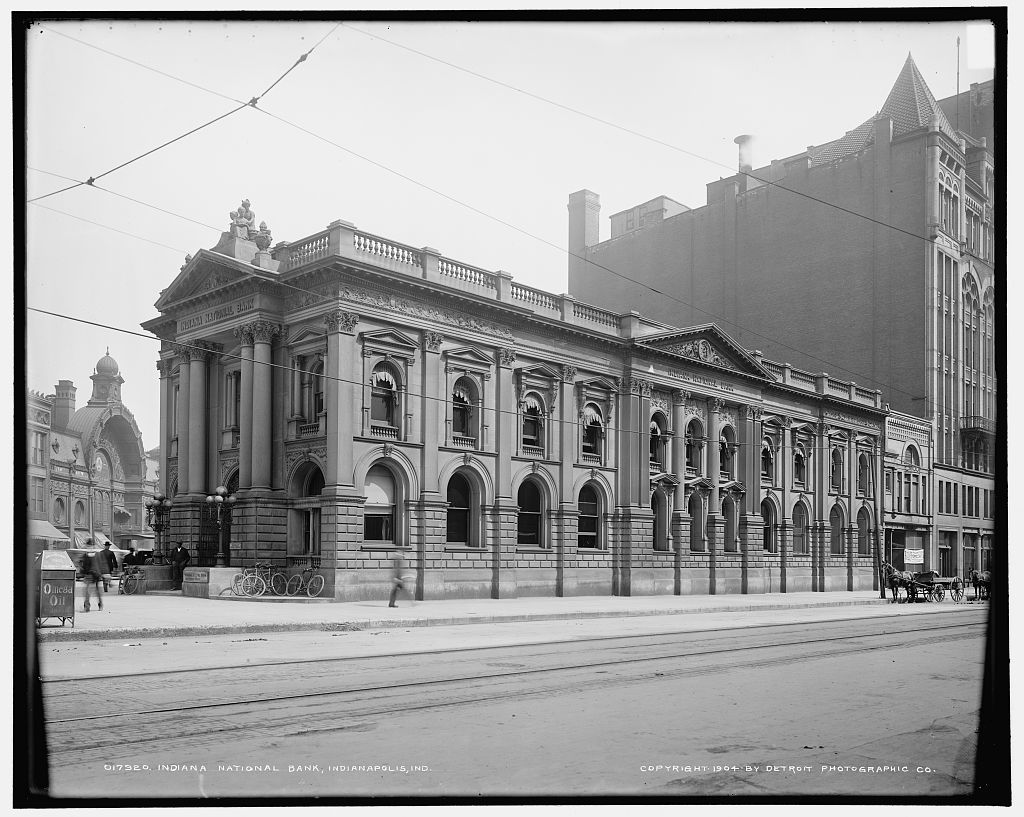

Indiana National, located at Washington and Meridian streets, enjoyed quiet growth during the rest of the 19th century. In 1882, Volney T. Malott purchased the bank, moved it to 11 East Washington Street, and expanded its customer base. In 1895, a massive fire destroyed the building, and (two years later) Indiana National opened the doors to its neoclassical building at 3 Virginia Avenue.

Indiana National acquired Capital National Bank in 1912. The bank continued its conservative management during the Great Depression and not only survived but grew during this period, acquiring the assets of Continental National Bank in 1933.

Indiana National took advantage of the economic vitality that occurred during World War II and the postwar period. Indianapolis experienced rapid growth, and Indiana National reached out to potential customers by establishing branches, the first on Maple Road (38th Street) in 1947. Indiana National also augmented its financial and customer base through the acquisition of other banks in the community, including Madison Avenue State Bank in 1948, Union Trust in 1950, and New Augusta State Bank in 1958. By 1968, INB had identified itself as the “Billion Dollar Bank.”

In 1969, Indiana National Bank created a larger holding company, Indiana National Corporation, which allowed the bank to engage in a wider range of activities and acquisitions. Then the largest bank in Indianapolis, Indiana National moved into the 37-story at One Indiana Square in 1970. The new tower symbolized the development of a corporate identity—a one-bank holding company—and Indiana National’s investment in the community. During the mid-1970s, the bank also became involved in urban development, forming a bank community development corporation.

The economic conditions of the 1980s contributed to a restructuring of banking institutions nationally. In 1986, INB began an aggressive program of acquisitions throughout the state as a result of the legislative changes at the state level that allowed banking across county lines. Indiana National Corporation became INB Financial Corporation in 1989. In 1992, NBD Bancorp, Inc., of Detroit, a regional bank holding company, purchased INB. It changed the name to NBD Indiana, Inc., in October 1993.

INB experienced another rebranding in 1998 when NBD merged with Bank One Corporation, the descendant of locally owned and historically its major competitor. Renamed Bank One Corporation, it was the sixth-largest bank in the U.S. at the time of the merger.

In 2004, J. P. Morgan Chase purchased Bank One for about $58 billion. The acquisition was completed in July of that year. It was the third-largest banking deal in U.S. history. The loss of locally owned banks in Indianapolis was part of a larger national phenomenon. According to the American Business History Center, of the 50 largest banks that existed in 1990, only 10 survived as independent banks by the end of 2020.

Help improve this entry

Contribute information, offer corrections, suggest images.

You can also recommend new entries related to this topic.